Pollen Street Capital Pillar III Disclosure

- SUMMARY

Pollen Street Capital (the “Group”) is an investment manager that manages a range of private equity and credit funds. The Group includes four entities that are authorised and regulated by the Financial Conduct Authority (“FCA”), two of which are obliged to disclose certain information relating to their capital position, risk management practices and remuneration to comply with regulatory disclosure requirements, commonly referred to as Pillar 3 disclosure (the “Disclosure”) requirements. This document, in conjunction with the relevant annual report and accounts for each entity, addresses these requirements.

- INTRODUCTION

- Business Description

The Group operates a relatively simple business model. It manages or advises seven private equity funds (the “PE Funds”) and two credit funds (the “Credit Funds”). The PE Funds invest in a range of high growth companies in the financial services or business services sectors. The legal form of each PE Fund is a partnership. One of the Credit Funds is Honeycomb Investment Trust plc, a UK listed investment trust, with the other credit fund being a private partnership. The Group derives income in the form of management fees and, in certain cases, performance fees. A group service company, PSC Service Company Limited (“PSC Service Co”), supplies staff, premises and other services to other members of the Group by way of a service agreement.

- Scope

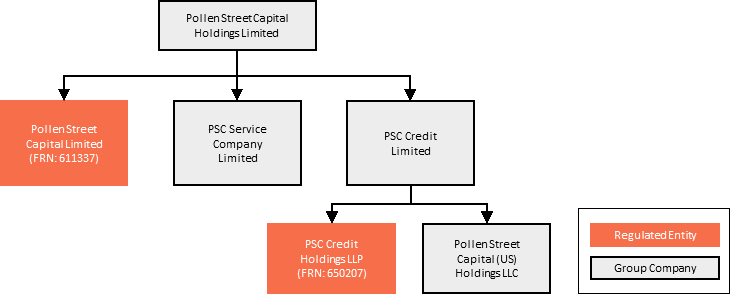

These Disclosures relate to two of the entities within the Group that are authorised and regulated by the FCA (individually a “Regulated Entity” or together the “Regulated Entities”), namely:

- Pollen Street Capital Limited

(“PSCL”) which is a limited company registered in the United Kingdom. It provides investment management services to several funds, as a full-scope FCA regulated Alternative Investment Fund Manager (an “AIFM”). It is classified as a Collective Portfolio Management Investment firm (“CPMI”). This classification requires the firm to adhere to the Alternative Investment Fund Managers Directive (“IPRU-INV”) prudential requirements and the BIPRU and GENPRU requirements

- PSC Credit Holdings LLP

(“PSCCH”) is a limited liability partnership registered in the United Kingdom. It provides investment management services to a single fund, as a full-scope FCA regulated Alternative Investment Fund Manager (an “AIFM”). It is also classified as a CPMI firm and therefore must adhere to IPRU-INV, BIPRU and GENPRU requirements.

Neither of the Regulated Entities are members of a UK consolidation group and are therefore not required to prepare consolidated reporting for prudential purposes and therefore do not need to consider impediments to transferring capital resources around the group or subsidiary capitalisation.Each Regulated Entity has separate governing bodies (the “Boards”).

- Pollen Street Capital Limited

- Group Structure

The following diagram summarises the entities covered by this document within the Group Structure.

- Coronavirus Disease

In March 2020, the World Health Organisation recognised an outbreak of a new virus that causes coronavirus disease 2019 ("COVID-19") as a pandemic. COVID-19 has caused significant disruption to businesses and economic activity which has been reflected in recent fluctuations in global stock markets. This disclosure is based on the position as at 31 December 2019. However, the Company has considered the impact of the emergence and spread of COVID-19 and does not believe the market uncertainties will significantly threaten the liquidity or solvency of either Regulated Entity.

- Brexit

On 1st January 2021, the UK’s transition agreement with the EU came to an end and the UK formally left the single market and customs union. The Company has considered the impact of Brexit and does not believe this will significantly threaten the liquidity or solvency of either Regulated Entity.

- Business Description

- GOVERNANCE

This section describes the Regulated Entities’ governance structure.

- Overview

The Boards have established a risk management framework to manage the Regulated Entities’ risk exposure and to ensure that they have adequate capital and liquidity resources to meet their liabilities as they fall due. The principal elements of the framework include:

- Risk appetite and risk limits have been established to control the exposure to risk. These limits exist to ensure that the Regulated Entities maintain an appropriate risk exposure and appropriate capital and liquidity resources. Risk exposures are reviewed regularly by way of a risk register and the financial limits are monitored on a monthly basis.

- A formal review of the Regulated Entities’ exposure to risk by way of an Internal Capital Adequacy Assessment Process (“ICAAP”) and Internal Liquidity Adequacy Assessment Process (“ILAAP”). These assessments are performed on an annual basis or more frequently if required.

- Committee Structure

The Boards are responsible for oversight of risks within their firms and have established a committee structure to deliver this. The committees that are most relevant for prudential risk management are detailed below; they meet at least quarterly.

- Executive Committee (“ExCo”): ExCo is responsible for management of the Group’s affairs, the operation of the Funds managed by the Group, the basis of advice given to Funds advised by the Group and the overall conduct of the Group. Members are empowered to make all relevant decisions regarding the conduct of the Group’s affairs.

- Group Risk Committee (“GRC”): The GRC is a sub-committee which reports directly to ExCo on all current and potential future risks associated with the Group’s business. The GRC may be convened should any material issue or breach of policy be identified, by any member of the Committee, which requires the immediate action by the Committee and/or escalation to the Boards.

- Operational Risk Committee (“ORC”): The GRC has established the ORC which provides a focus for implementing the operational risk framework consistently throughout the Group. The ORC reports to the GRC and has responsibility for monitoring compliance with the policies and procedures of the Group as well as other matters. The ORC meets as required to review operational risk matters.

- Risk Reporting and Measurement

The Risk Function and Finance teams are responsible for producing reports for the ExCo, GRC, ORC and Boards, which provide oversight of the risks. The Risk Function identifies, measures, monitors and reports on risk within the activities of the business and support functions, including:

- Scenario analysis and stress tests covering matters such as outputs based on the most significant risks identified within the Regulated Entities. This informs the Boards of the Regulated Entities how risks are likely to behave and what, if any, impact there is likely to be to the balance sheet

- Identification of the most material risks to the Regulated Entities’ business. The scenario analyses and stress tests assist in the Regulated Entities’ risk management and capital planning

- Risk Mitigation & Hedging

The Regulated Entities mitigate their risk exposure by carefully assessing the gross risk, mitigating actions and the resulting net risk. Where deemed appropriate third-party insurance or hedging is executed to reduce risk exposure, although it is acknowledged that it is not possible to hedge many risk types.

- Overview

- RISK MANAGEMENT

The Regulated Entities have established a risk management process in order to ensure they have effective systems and controls in place to identify, monitor and manage risks arising in the business. The Boards have identified that business, operational, market, credit and liquidity are the main areas of risk to which the Regulated Entities are exposed. These are discussed in the remainder of this section.

- Business Risk

Business risk is the risk that the firm may not be able to carry out its business plan or strategy. The Regulated Entities’ revenue is reliant on the performance of the existing funds under management and the ability to launch new funds or obtain new mandates. In analysing the impact of this risk, the Regulated Entities have considered a variety of stress tests covering different scenarios.

- Operational Risk

The Regulated Entities have identified a number of key operational risks. These relate to disruption of the office facilities, system failures, trade failures and failure of third-party service providers. Appropriate policies are in place to mitigate against risks, including appropriate insurance policies and business continuity plans.

Some key operations are outsourced to third party providers such as administrators, mitigating the exposure to operational risk. The Regulated Entities have an operational risk framework in place to mitigate operational risk.

- Credit Risk

The Regulated Entities are exposed to credit risk in respect of their debtors, management and performance fees billed, and cash held on deposit. Management fees are settled monthly and performance fees are generally settled annually. Other credit exposures include bank deposits, which are held with large international credit institutions, and office rental deposits.

The Regulated Entities undertake periodic impairment reviews of receivables. All amounts due to the Regulated Entities are current and none have been overdue during the year. As such, due to the low risk of non-payment from counterparties, management is of the opinion that no provision is necessary. A financial asset is overdue when the counterparty has failed to make a payment when contractually due. Impairment is defined as a reduction in the recoverable amount of a fixed asset or goodwill below its carrying amount.

The Regulated Entities’ main exposure to credit risk is the risk that management and performance fees cannot be collected. As this exposure is to the Funds that the Group manages or advises, credit risk is considered to be low. The Regulated Entities hold all cash balances with banks which have been assigned strong credit ratings or considered systemically important in the jurisdiction in which they are regulated.

- Business Risk

- CAPITAL RESOURCES

Both Regulated Entities hold 100% of their capital base in the highest quality form of regulatory capital, namely common equity tier 1 (“CET1”). This consists of share capital, share premium, audited retained profit and other relevant qualifying reserves, therefore the Regulated Entities do not have any incentives to redeem capital instruments.

The following tables disclose a reconciliation between the draft statutory financial statements and the available capital resources, of own funds, as at 31 December 2020.

-

Figure 1 - PSCL Capital Resources

As at 31 December 2020

£’000

Net Assets

3,224

Hybrid Capital

nil

Tier 2 Capital

nil

Deductions

Deferred Tax Asset

nil

Total Own Funds

3,224

-

Figure 2 - PSCCH Capital Resources

As at 31 December 2020

£’000

Net Assets

5,269

Hybrid Capital

nil

Tier 2 Capital

nil

Deductions

Amounts Due from Members

(4,769)

Total Own Funds

499

-

- CAPITAL REQUIREMENTS

- Pillar 1 Capital Requirements

The Regulated Entities must comply with all of the following three capital requirements: Base Capital Requirements, Variable Capital Requirements and CPM Capital Requirement. However, many of the disclosure requirements are set by way of a Position Risk Requirement (“PRR”) or Risk Weighted Assets (“RWA’s”) which are a different basis. These are calculated on different bases. The table below sets out the three capital requirements of the Regulated Entities as at 31 December 2020.

Line Item

PSCL (£’000)

PSCCH (£’000)

Base Capital Requirement

113

113

Variable Capital Requirement

226

102

CPM Capital Requirement

632

121

The reporting currency of the Regulated Entities is Pound Sterling (“GBP"), but each entity holds foreign currency assets in the form of cash or debtors and calculates foreign currency PRR. The table below shows the foreign currency PRR for each Regulated Entity as at 31 December 2020.

Line Item

PSCL (£’000)

PSCCH (£’000)

Cash

(held in EUR and USD)628

387

Debtors

(held in EUR and USD)1,678

123

Total

2,305

510

Foreign Currency PRR

184

41

The Regulated Entities do not hold any trading-book or commodity exposures and therefore had no exposure or capital requirements in relation to these as at 31 December 2020. This is set out in the table below.

Line Item

PSCL (£’000)

PSCCH (£’000)

Interest Rate PRR

nil

nil

Equity PRR

nil

nil

Option PRR

nil

nil

Collective Investment Schemes PRR

nil

nil

Counterparty Risk Capital Component

nil

nil

Commodity PRR

nil

nil

- Internal Capital

The Regulated Entities take the higher of Pillar 1 and 2 as the ICAAP capital requirement. The Regulated Entities have assessed Business Risks by modelling the effect on their capital forecasts and assessed Operational Risk by considering whether Pillar 1 capital is adequate, taking into account the adequacy of the mitigation.

- Pillar 1 Capital Requirements

- REMUNERATION DISCLOSURE

The Group has determined it good practice to establish a remuneration committee to ensure the remuneration policy is consistent with the business strategy, objectives, values and interests of the Group and the funds it manages, and the investors of such funds*.

All staff receive a fixed regular salary-based remuneration and are eligible for an annual, variable, discretionary bonus award. Receipt of an award under the scheme will be based upon the performance of the Group’s activities as a whole and in combination with the relevant individuals’ contribution to that performance, as assessed by the remuneration committee. Bonus awards are subject to malus and clawback terms as described in the Group’s Remuneration Policy. Further, bonus awards are subject to deferral for awards over a designated threshold. The deferral percentage and threshold is set by the remuneration committee and will be confirmed prior to the payment of such awards. Currently, any deferred bonus is paid on a prorated basis over three years.

The Group performs annual performance reviews with the objective of appraising staff performance but also to identify any training needs and whether staff are performing in line with the objectives set for them. In addition to the reviews, each member of staff’s conduct is reviewed during the performance year. The review process and information collected around staff conduct is taken into consideration when determining fixed and variable remuneration rewards and all performance reviews specifically assess each individual's approach and contribution to risk, risk management and governance.

The Boards consider the following factors when deciding whose professional activities have a material impact on the risk profiles of the Regulated Entities:

- those who are in senior management positions and authorised in an FCA senior management function

- those who are ultimately responsible for individual business units

- those who are senior officers in the risk management and compliance functionsThe table below sets out the aggregate quantitative information on remuneration of these staff. Figures represent the financial year ending 31 December 2020 and apply to each Regulated Entity separately.

Business Area

Senior Management**

Number of Staff

9

Remuneration

Fixed £’000

2,193

Variable (Non-Deferred Cash) £’000

1,657

Variable (Deferred Cash) £’000

419

Total £’000

4,270

Deferred Remuneration (Vested) £’000

806

Deferred Remuneration (Unvested) £’000

1,646

No new sign-on or severance payments were made during the financial year for these members of staff considered to be material risk takers. - APPENDIX

This appendix discloses other information that is required to be disclosed that is not included elsewhere.

- Publication Media & Location

This disclosure is published on the Pollen Street Capital website, which in conjunction with the Regulated Entities’ annual report and accounts, addresses the disclosure requirements.

- Publication Frequency

The Regulated Entities have reviewed the publication frequency for these disclosures in light of the relevant characteristics of the business, most notably the degree of stability of the capital position and risk exposure as well as the criteria listed under BIPRU 11.4.4. The Boards concluded that this disclosure should be published annually.

- Comprehensiveness

The Regulated Entities regard information that is in this Disclosure to be comprehensive, subject to the Materiality and Confidentiality statements noted below.

- Materiality

The Regulated Entities regard information that is eligible for this disclosure as material if its omission or misstatement could change or influence the assessment or decision of a user relying on that information for the purpose of making economic decisions. If the Regulated Entities determine that certain information is not material, then it may be omitted from this statement.

- Confidentiality

The Regulated Entities regard information that is eligible for this disclosure as proprietary or confidential if sharing that information with the public would undermine the Regulated Entities’ competitive position. The Regulated Entities always regard information as confidential if they have obligations to customers or counterparties that bind the Regulated Entities to confidentiality. If the Regulated Entities determine that certain information is proprietary or confidential, then the information will be omitted that information from the report. No information has been omitted from this report for confidentiality reasons.

- New Prudential Standards

The European Commission proposed a new set of rules in December 2017, namely the Investment Firms Regulation and the Investment Firms Directive. These rules establish a new framework for prudential requirements for investment firms with a three-tier classification system:

- Tier 1: This includes firms that engage in underwriting and dealing on own account with a balance sheet in excess of €30 billion. They will be subject to the CRD rules. These firms are also likely to be subjected to Single Supervisory Mechanism (‘SSM’) (European Central Bank Supervision);

- Tier 3: Small and non-interconnected firms with assets under management of less than €1.2 billion; and

- Tier 2: All other firms not included in either Tier 1 or Tier 3 definitions.

The Group expects both Regulated Entities to be classified as Tier 2. The new regime will apply from 26 June 2021, albeit with transition provisions and subject to the United Kingdom’s exit from the European Union. A new set of calculations called K-factors will be used to calculate the Pillar 1 capital requirement. The Group is preparing for the new regime in advance of the applicable date.

- Publication Media & Location

- Verification

This Disclosure has been prepared diligently, however the information contained in this document has not been audited by the Regulated Entities’ external auditors.

- Other Disclosure Requirements

- Market Risk

Market risk is the risk that asset price fluctuations cause the firm to make losses. The Regulated Entities do not hold any financial assets that are subject to material price fluctuation, therefore neither Regulated Entity has a material exposure to market risk. The Regulated Entities do not use value at risk models to calculate market risk capital requirements as defined by BIPRU and GENPRU.

- Non-trading Book Exposure to Equity

The Regulated Entities do not hold equity positions in their non-trading book.

- Interest Rate Risk in the Non-trading Book

Interest rate risk is the risk that a firm’s income or expenses vary as a result of changes to market interest rates. The Regulated Entities do not have any borrowings and earn an immaterial amount of interest income from their treasury balances. However, the Regulated Entities’ performance fee that they receive from the funds they manage may depend on interest rates as the funds are exposed to interest rate risk. The Boards of the Regulated Entities have considered this as part of the Business Risk.

- Securitisation

The Regulated Entities have not undertaken securitisation activities.

- Internal Ratings Based Approach

The Regulated Entities do not use the Internal Ratings Based Approach to calculate risk weighted assets as defined by GENPRU and BIPRU.

- Credit Risk Mitigation

The Regulated Entities do not make use of credit risk mitigation techniques as defined by GENPRU and BIPRU.

*The Group is not required to establish a remuneration committee given that it is not significant in terms of its size, internal organisation and the nature, the scope and the complexity of its activities.

- Market Risk

**The Group ended the year with 8 members of ExCo, however 9 members served during 2020 and the figures in the table include all members who served during the year.